Roadmap to Success

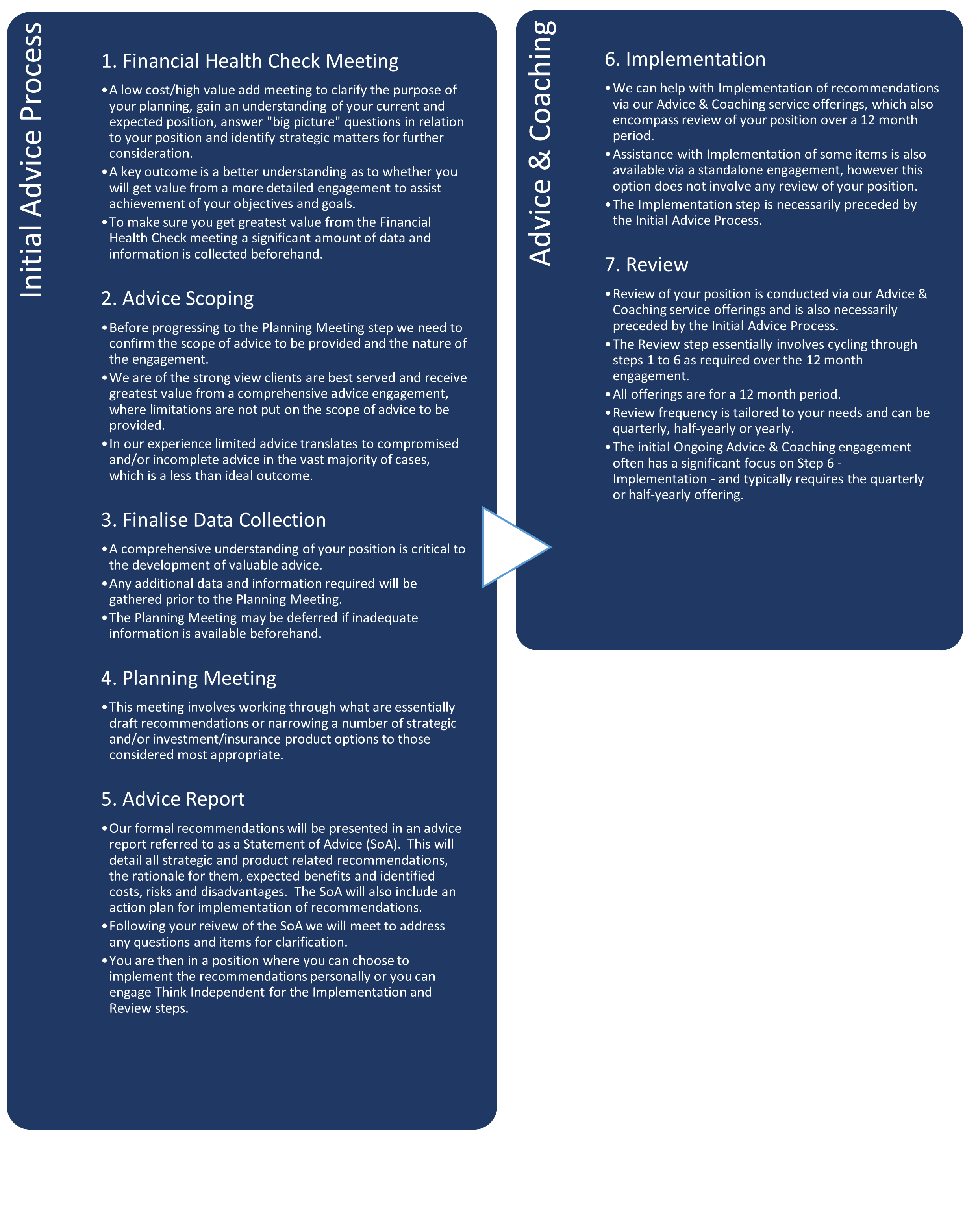

Success in most areas of life requires planning. Without planning you don't know where you are going, how to get there or even why you want to go there in the first place. Financially successful people know where they are going and why. They explore their strategic options and develop a roadmap for their success.