Still the 8th Wonder of the World

January 3, 2018Financial One-Stop-Shops

February 6, 2019I recently saw it reported that 95% of insurance premiums are paid monthly. So what you say? Surely that helps with managing cash flow.

I suspect it does, but maybe not the cash flows you’re thinking. Call me cynical, but I think it has more to do with the cash flow position of the adviser that sold the policy and the insurer than it does the policyholder. Let me explain.

It is an adviser’s role to advise clients on their personal insurance needs and even to establish appropriate cover. In doing so the adviser needs to make sure the premiums are structured in a manner that achieves the best outcome for the client and to make sure that client’s pay as little as they can for the cover that they need. There are a number of aspects to this, but the one we are focusing on today is premium payment frequency.

Why pay more?

Typically you pay 6%-8% more to pay premiums monthly versus annually. Even half-yearly premium payments are typically 3%-4% more than annual payments. Good financial planning involves locking in as many of the guaranteed wins as you can and a guaranteed 6%-8% return is something I’d be happy to lock in every day of the week for my clients. So why is this only being recommended and implemented up to 5% of the time?

Sometimes the answer is validly cash flow. The person simply doesn’t have the full amount at the time, but this should only be the case some of the time, not nearly all of the time.

You’ve been sold

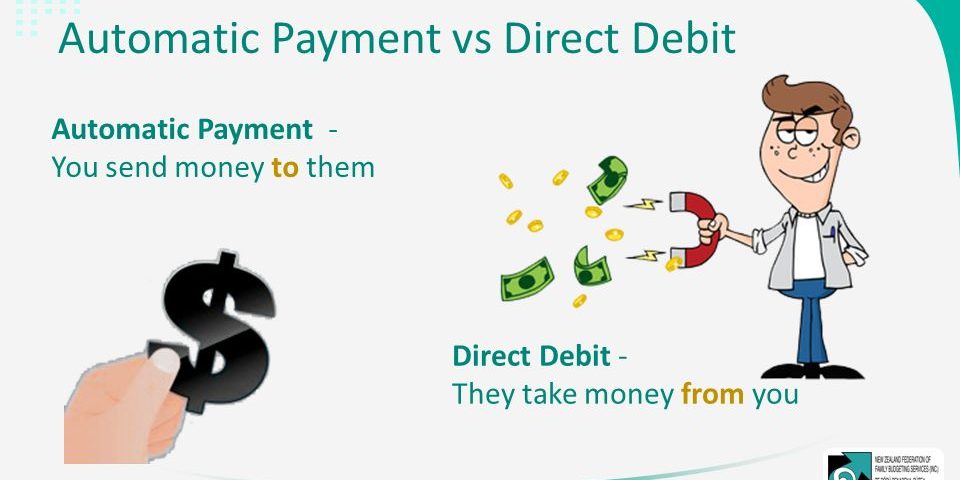

Underlying the practice of monthly premiums and use of direct debit are sales techniques designed to trick you and trap you.

Firstly, it breaks the total cost into a much smaller amount, making it appear less expensive. Sadly, as humans we aren’t good at taking it back to the full annual cost.

Secondly, it automates the payment, meaning we don’t see it or feel it unless we read our bank or credit card statements line by line. Out of sight, out of mind.

Thirdly, we have to do something to stop it from being drawn from our account. Again, as humans we are pretty flawed and we often can’t be bothered stopping it, even if we don’t want to pay it. So we keep paying for it.

These are sales techniques used very broadly, it’s not just in financial services. It’s everywhere. If you’ve ever paid for something by instalments, it’s a fair chance the ability to do this was the factor that made the sale happen.

It’s time for change. It’s time for action.

Now I’m not suggesting you go out and cancel your insurance simply because it is on monthly direct debit or even stop using direct debit. What I am suggesting is that you pay premiums annually, rather than monthly or even half-yearly. It is very likely you will achieve a guaranteed return you won’t get elsewhere. You will also see and feel the true cost and make conscious decisions as to whether you are getting value.

If you can afford to pay more via monthly payments you can afford to pay the lesser amount annually. You just have to have the full amount in your bank account at the time. This is not a question of affordability. I’ve heard that argument before and it simply doesn’t fly.

Remember advisers taking commissions on insurance, which is the vast majority, are incentivized to increase premiums. The more you pay, the more they get. Don’t rely on them to be looking out for you on this matter, as they clearly aren’t.

Disclaimer

This advice is of a general nature only and may not be relevant to your particular circumstances. The circumstances of each person are different and you should seek advice from a financial planner who can consider if any strategies or products mentioned are right for you.