This Ain’t No Joke

“Simplicity is the ultimate sophistication.” – Leonardo da Vinci

September 4, 2017

Behave Your Way to Success

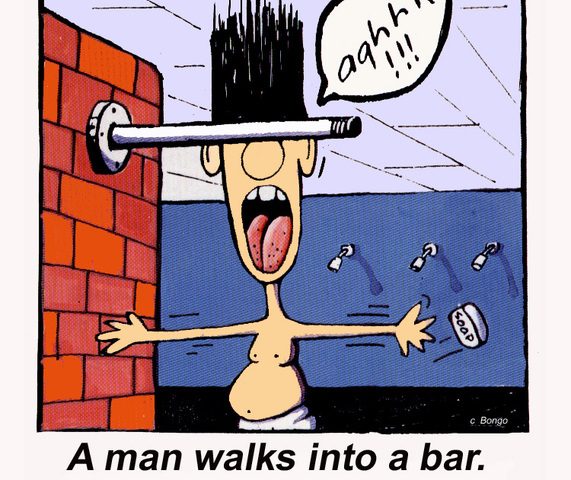

November 10, 2017“A man walks into…” Like the cartoon above, a lot of jokes start with this line, but what I’m about to tell you is no joke. Unfortunately, it is very real and happening every day.

Does this sound ridiculous?

A man (or woman) walks into…. their local Toyota dealer. They are after a cost effective, reliable, value for money solution to their transport needs.

Now before the dealer’s sales staff can sell you a car from their range the man needs to pay an advice fee ranging from $3,000 to $5,000, so that an appropriate vehicle can be determined and recommended. Believe it or not, the man agrees. The salesman seems like a good person and the man was expecting to pay some fee for advice. Again, believe it or not.

Conversations follow where the man’s transport needs are determined, the range of vehicle options are considered and it is clear (at least to the salesperson) a low to mid-range Camry is more than adequate, as it meets all the man’s needs. As you’d expect the salesman is very happy to sell the man a Camry, but a Camry with all the bells and whistles or even a Kluger is more financially rewarding for the salesperson and their employer, so that is what is recommended.

The salesman also recommends on ongoing servicing package at a cost of a further $3,000 to $5,000 per annum. Now at this point the man is starting to notice the increasing fee load, but modern cars are so complicated and sophisticated and he knows he can’t service the vehicle himself, so he agrees.

Does this sound ridiculous? I suspect you think it is. You’d never accept this arrangement.

Do I feel lucky?

Now replace Toyota with the name of a bank of your choosing, “transport needs” with “financial planning needs”, cars with super funds or investments and Camry and Kluger with comparable financial products from the bank’s product range. What you then have is financial planning as practiced by financial product providers, including the banks, investment managers and insurance companies.

What was seconds ago ridiculous is common industry practice in the financial planning world and all too often accepted by people seeking financial planning advice. Making it worse is that rarely do you even get true financial planning advice. You get a scaled back version focused on the sale of products rather than comprehensive advice on how your interactions with the financial world can help you and your family live a better life.

If you don’t want to buy a car, you don’t go into a car dealership. Similarly, if you are looking for real advice and don’t want to be sold a financial product, don’t go into a bank or seek the assistance of someone connected to a financial product provider. 9 times out of 10 you will be sold a product and if you are lucky you may get some advice.

So as Clint Eastwood says in Dirty Harry, “You’ve got to ask yourself one question. Do I feel lucky? Well do ya, ….?”

If you walk into a bank looking for financial planning, you’ve been warned. If you walk into a financial planning practice, read the Financial Services Guide an adviser is required by law to provide. I know it’s boring, but it will tell you if a financial product provider, such as a bank or insurance company, is influencing the adviser’s advice and if they receive commissions or other conflicted forms of payment. It often isn’t obvious.

Most advisers operate under a licence controlled by a bank, investment manager or insurance company, so sometimes it’s not much better than the bank option. Similarly, if the adviser receives commissions or charges asset based fees, the conflicts with your interests should again be clear.

There are good advisers out there providing independent, conflict free, advice focused on you. Put in the effort and take the time to find one.

Disclaimer

This advice is of a general nature only and may not be relevant to your particular circumstances. The circumstances of each person are different and you should seek advice from a financial planner who can consider if any strategies or products mentioned are right for you.