Financial Planning

February 20, 2017

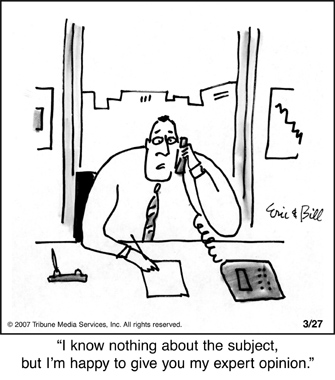

If you’re thinking “I hope so, that’s what I’m paying them for” I’ve got some bad news for you. It’s highly likely your financial planner/adviser is not qualified to manage investment of your money. For starters let’s clarify what I’m talking about. I’m talking about the day-to-day management of your investment portfolio (e.g. whether you sell BHP shares to fund the purchase of NAB shares […]

August 17, 2016

For some the option of a Self Managed Super Fund (SMSF) is the ultimate expression of control over their finances. They get to control how their capital is invested with relative freedom and save on costs at the same time. For others this is simply the story they are sold. Two recent experiences only served to reinforce earlier experiences of the misuse of SMSF’s, where […]

July 19, 2016

There are a lot of myths in investing and a big one is that you will never lose money in bricks and mortar. Well the simple answer is that not only can you, but that many people do every day. And they lose a lot. CoreLogic® RP Data’s – Pain and Gain December Quarter, 2015, report provides some hard numbers to disprove this myth by […]

May 14, 2016

A lesson we can all take from how AustralianSuper manages its investment portfolio is eliminating intermediaries where they aren’t seen to be necessary or to add value. AustralianSuper regularly invests directly in major property and infrastructure assets, removing the use of an intermediary structure and/or manager. It is also internalizing management of a significant portion of its Australian equity exposure, which will remove the cost […]

April 14, 2016

Simple v. Simplistic At Think Independent we aim to make clients financial affairs simple. What do we mean? Importantly, we don’t mean simplistic. We are not looking to achieve simplicity for the sake of simplicity. Rather we are looking for simplicity within the framework of our client’s goals and the available options. If we use a couple, John and Jan, who are saving for life […]

March 24, 2016

Chris Cuffe is best known to many as the guy that received a massive payout (nearly $33 million) in 2003 following Commonwealth Bank’s purchase Colonial First State and his exit from the business. Much criticism was heaped on Chris Cuffe at the time, with few acknowledging he was a key hand in Colonial First State owners and investors making much more over preceding years. Was it […]

March 14, 2016

Before I dish the dirt on insurance commissions, let’s be clear that what I’m about to tell you does not in any way impact on your need for insurance, only how you go about establishing life and disability insurance. If you are not sure whether you need insurance please refer to last months post. OK, lets get going. Anyone that has taken out life or […]

February 14, 2016

Do I really need life and disability insurance? Before you can answer this question you need to provide some honest answers to a number of questions. But first, let’s set a foundation for considering these questions. Human Capital v. Financial Capital When we start out in life on our own, taking over responsibility for ourselves from our parents, we typically have a lot of human […]

January 14, 2016

I was forwarded the following article recently (hold off reading for a minute). Normally the article title alone would have been enough for me to not bother reading it, as I could only see the first part, “I retired at 30”. Probably just another get rich quick story to be avoided I thought. Maybe I was a little jealous also as I’m more than a […]

December 14, 2015

A few weeks ago our daughter asked if we were poor. We don’t spoil our kids, but still this question came as a bit of a surprise, as they don’t go without much either. I asked her why she thought we were poor. “Because we don’t drive a new car or live in a fancy house.” The answer was illuminating. Putting the dented ego aside […]

November 14, 2015

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” ― Albert Einstein Einstein isn’t the only smart person that understands the power of compound interest. Regarded by many as the greatest investor of all time, certainly the best known, Warren Buffett has built one of the world’s greatest ever financial fortunes largely off […]