Uncategorized

August 3, 2020

A recent article in Financial Standard ( https://www.financialstandard.com.au/news/super-switching-three-times-higher-cfs-159862808 ) based on data from Colonial First State has again highlighted how human emotions don’t mix well with financial markets. This is a story told many times before, but worth telling again. We need to be constantly reminded. Some background first, financial markets started selling off in February on the back of concerns as to the impact […]

August 15, 2019

There is a link to a great article by Noel Whittaker below, with a particular focus on property spruikers, but as he highlights the principles relate to any form of investment or strategy that is being spruiked. Like Noel, I’ve met plenty of victims of these spruikers and it is typically their unfortunate experience that prompted them to seek out truly independent advice. https://www.firstlinks.com.au/article/six-warning-bells-against-property-spruikers?utm_source=Website+Subscribers&utm_campaign=9a50fb01ab-EMAIL_CAMPAIGN_8_15_2019_319&utm_medium=email&utm_term=0_953154ac75-9a50fb01ab-83786745 The […]

February 6, 2019

Every now and then I do a Google search on independent financial advice or a variation to see what comes up. Yes, I’m checking to see if Think Independent does, but let’s move on. Too often there are advice practices that are far from independent. That’s a problem but not what this post is about. A recent search brought up a practice that upon further digging is what you […]

September 11, 2018

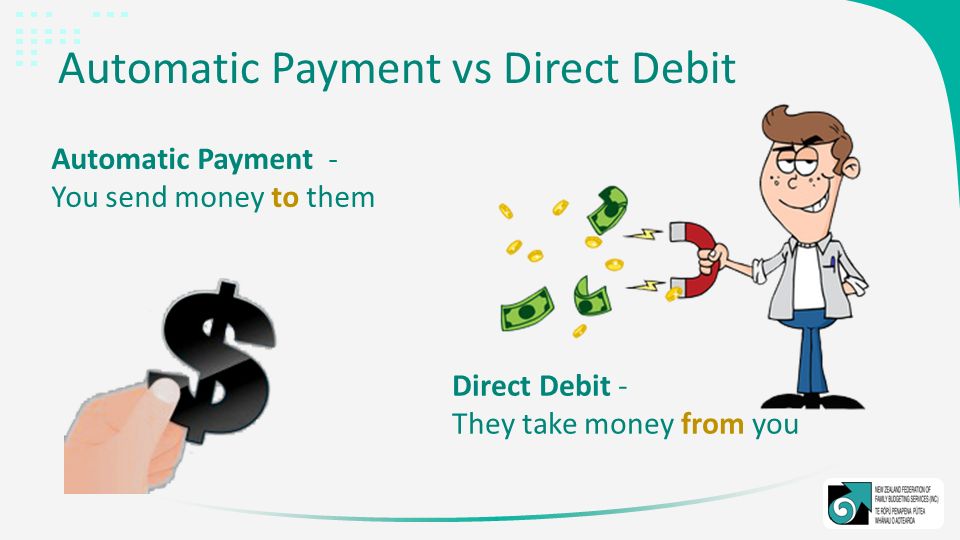

I recently saw it reported that 95% of insurance premiums are paid monthly. So what you say? Surely that helps with managing cash flow. I suspect it does, but maybe not the cash flows you’re thinking. Call me cynical, but I think it has more to do with the cash flow position of the adviser that sold the policy and the insurer than it does […]

January 3, 2018

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” ― Albert Einstein Einstein isn’t the only smart person that understands the power of compound interest. Regarded by many as the greatest investor of all time, certainly the best known, Warren Buffett has built one of the world’s greatest ever financial fortunes largely off […]

November 10, 2017

A recent post on LiveWire (link below) identifying 11 habits to avoid for better investment performance is worth a quick look, not just for how it could help you as an investor, but for how a better understanding of the habits it refers to can help you in everyday life. The post identifies 11 natural human behaviours that are often counterproductive when applied to decisions […]

October 10, 2017

“A man walks into…” Like the cartoon above, a lot of jokes start with this line, but what I’m about to tell you is no joke. Unfortunately, it is very real and happening every day. Does this sound ridiculous? A man (or woman) walks into…. their local Toyota dealer. They are after a cost effective, reliable, value for money solution to their transport needs. Now […]

September 4, 2017

In prior posts, we have highlighted the value in pursuing simple solutions, over complex or simplistic solutions. It has also been highlighted that our desire as humans to feel special can lead us to the misconception we must seek out “special” solutions, which not surprisingly come at a significant price and in reality aren’t special at all. I would like to pick up on da […]

June 20, 2017

ASIC recently released a report into the behaviour of financial advisers controlled by the big 4 banks and AMP. It probably won’t surprise many that the findings weren’t great, but it was a non-headline grabbing and little reported finding that caught my eye. Further, it is an issue that is not confined to the big 4 and AMP. It is an issue involving the vast […]

May 22, 2017

Time for a New TV After getting sick of sharing TV time with the kids we recently decided it was time to replace the broken second TV. Now electrical items fall under my jurisdiction in our house, be that a good thing or not, and it was my job to buy the new TV. In a prior work life I worked for one of the […]

April 15, 2017

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so. “ – Mark Twain I love Mark Twain quotes. He cuts through seemingly complex and confusing matters with such precision and gets to the heart of the issue. The above quote is another great example. Mark Twain’s quote is alluding to a tendency to believe […]

March 20, 2017

It was suggested to me recently that I should write a book about what I know to help those looking for financial planning help. But what could I write about that hasn’t been done to death before. There are plenty of books out there talking about wealth accumulation strategies, super, investment fundamentals and strategies, risk management (insurance) and estate planning, etc. and to be honest […]